impact of steel tariffs on box springs The 2018 tariffs on steel raised the price of steel in the U.S. By 2019, there were about 1,000 more jobs in steel production but 75,000 fewer in industries that use steel as an input and became less competitive. . Tariffs . Built with a strong and durable steel frame and a versatile poly jacquard cover that slips right on, the Smart BoxSpring® is the picture of dependability for any mattress. All packed in a compact shipping box with everything included, even our 5-year worry free warranty!

0 · why are steel tariffs so high

1 · why are steel tariffs downstream

2 · why are steel tariffs down

3 · why are steel tariffs bad

4 · tariffs on steel products

5 · steel tariffs impact on manufacturing

6 · steel tariff profitability

7 · steel tariff increases

The Classic Bento® Stainless Lunch Jar contains three microwaveable inner bowls (including a soup bowl), a forked spoon, chopsticks, carrying strap and protective cover. The outer container is vacuum insulated, providing excellent heat retention.

New data and research are beginning to emerge on the impact that these tariffs, which are taxes on foreign steel and aluminum, have had on steel and other U.S. manufacturing industries. Expanded tariffs could protect some manufacturers from foreign competition, but economists warn that they would also drive up inflation. . and a ,000 mattress and box spring set would cost .

The 2018 tariffs on steel raised the price of steel in the U.S. By 2019, there were about 1,000 more jobs in steel production but 75,000 fewer in industries that use steel as an input and became less competitive. . Tariffs . The 2018 steel tariff made U.S. steel manufacturing more profitable, but at a cost to the greater economy. The Trump Administration imposed a 25% tariff on foreign steel in . The financial impact on firms in their supplier and customer industries was mixed. "These findings demonstrate the ripple effect of unintended consequences that tariffs can lead .Just over one year later, the U.S. manufacturing industry has seen both positive and negative impacts of these tariffs, some intended, and some not. Big U.S. steel manufacturers, such as Nucor Corp., Steel Dynamics Inc. and United .

Trump has proposed adding a tariff of 10% to 20% on all imports, with significantly higher levies on imports from China. Shipping containers are stacked together at the Port of . The Trump administration imposed several rounds of tariffs on steel, aluminum, washing machines, solar panels, and goods from China, affecting more than 0 billion worth of trade at the time of implementation . In this section I provide a brief overview of the Bush steel tari s, show that they were a meaningful shock to steel imports in the United States, and discuss some advantages of .

In recent years, some in Congress have come to view global overcapacity and excess production of steel, which has tended to result in a reliance on often cheaper imported steel instead of . Trump promised a new dawn for the struggling U.S. steel industry in 2016, but higher steel prices due to his tariffs have dented demand. . GM declined to comment on the tariffs' impact. A Ford . President Donald Trump is planning to institute broad tariffs on steel and aluminum imports. These import taxes could result in lower profits for all . tariffs could have a substantial impact on everything from tractors to tuna fish cans. . P.O. Box 840 Chesterfield, MO 63006. Phone: +1 (636) 537-2393 Fax: +1 (636) 537-8795.

why are steel tariffs so high

The 2018 tariffs on steel raised the price of steel in the U.S. By 2019, there were about 1,000 more jobs in steel production but 75,000 fewer in industries that use steel as an input and became less competitive. . Tariffs . New data and research are beginning to emerge on the impact that these tariffs, which are taxes on foreign steel and aluminum, have had on steel and other U.S. manufacturing industries.

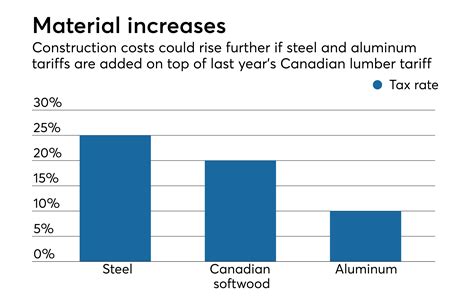

Hellwig Products, Torklift International, and SuperSprings International discuss the potential impact of higher steel and aluminum prices on their companies, and the greater truck camper marketplace. As of June 1st, the United States has imposed a 25-percent tariff on steel and a 10-percent tariff on aluminum.

In May 2024 there was another change to steel tariffs as the US tripled the Section 301 tariffs on Chinese steel. As a part of the Trade Act of 1974 , Section 301 addresses unfair trade practices and allows the President to retaliate against countries engaging in these practices like intellectual property theft, currency manipulation, or export .

In a recent trade move, the White House enacted a 25 percent tariff on foreign-made steel and also a 10 percent tariff on aluminum. From U.S. trade partners to global companies with vast supply chains, reactions have been strong. On June 1, the exemptions on Canada, Mexico and the European Union (EU) expired.

imports after the imposition of tariffs, τ is the tariff rate, and (m0 – m 1)/m 0 is the percentage change in the quantity of imports due to the imposition of the tariffs. m D A C m 1 m 0 S* S*(1 + τ) p*τ B D p p* 1 p* 0 = p 0 p 1 =p* (1 + τ) Figure 1 Impact of a Tariff on Prices Source: Authors. WASHINGTON Tire manufacturers still are assessing the possible effects of 25 percent tariffs on tire-quality steel wire rod imports to the U.S., but all indications are that the impact could be sweeping.Latest China HS Code & tariff for spring - Tariff & duty, regulations & restrictions, landed cost calculator, customs data for spring in ETCN. China customs statistics trade data. Home; Sign in; . 7320102000Leaf springs and leaves for springs, of iron or steel, for motor vehicles.

Steel tariffs are effecting the cost of Anchor Bolts, Shims, Hillside Washers, and Wire Rope. . Steel and Aluminum Tariffs Impact on Buildings Industry. 05/20/2019 . 35 Pine Drive, Cold Spring Harbor, NY 11724 * Warehouse and Factory: 109 Kean Street, West Babylon, NY 11704 * Phone 631-385-7273 * Fax 631-385-7274 . The Section 232 tariffs on steel and aluminum reduced employment, raised prices for consumers, and hurt exports. Explore steel tariffs and aluminum tariffs. . Lydia Cox, “The Long-Term Impact of Steel Tariffs on U.S. Manufacturing,” Harvard University Department of Economics (Nov. 7, 2021), https: . In early 2018, the US reached agreements to permanently exclude Australia from steel and aluminum tariffs, use quotas for steel imports from Brazil and South Korea, and use quotas for steel and aluminum imports from Argentina. In May 2019, President Trump announced that the US was lifting tariffs on steel and aluminum from Canada and Mexico.

This post first appeared on Risk Management Magazine.Read the original article.. In March, the Trump administration sparked an outcry by announcing that it would impose import tariffs of 10% on aluminum and 25% on steel, following earlier tariffs on solar panels and washing machines.This is the reason we have applied for exclusions from the steel tariffs for these products. Those product exclusions are Request No. N-330.01 through .07. A.J. Rose has been able to grow and add jobs because we manufacture high quality products that a limited few can do. Now, however, with the steel 201 tariffs everything has changed. U.S. President Donald Trump recently shook up global financial markets by announcing plans to enact import tariffs of 25% on steel and 10% on aluminum.

Big U.S. steel manufacturers, such as Nucor Corp., Steel Dynamics Inc. and United States Steel Corp., have benefited from the tariffs. Imports of steel from foreign competitors decreased approximately 11% in 2018 from 34.5 million .In this paper, I study the long-term effects that temporary upstream tariffs have on downstream industries. Even temporary tariffs can have cascading effects through production networks when placed on upstream products, but to date, little is known about the long-term behavior of these spillovers. Using a new method for mapping downstream industries to specific steel inputs, I . By Steven Schommer, President, Adrenaline POP company You may not be aware, but we are experiencing an incredibly volatile metals market RIGHT NOW ignited by the steel and aluminum Tariffs. Steel .

President Trump announced new steel and aluminum tariffs in March of 2018. This was a tariff of 25% on all steel imports, with the exception of those from a handful of exempted countries: South Korea, Australia, Argentina, Brazil, Canada, Mexico, and the European Union were exempted at first, but were then included in the tariffs starting in .The nation’s Commerce Ministry said the tariff hike “will seriously impact the atmosphere of bilateral cooperation.” Promo leaders will be watching what retaliatory measures China advances. “Impacts from these tariffs will certainly be felt beyond the promo industry and by the broader economy,” Lederer told ASI Media.

This has led some to warn that tariffs typically end up harming the exporting country but also consumers and businesses from the importing nation. Two recent tariffs, imposed in the pre-Trump era, support those findings. In 2002, President George W. Bush raised tariffs on selected steel products in hopes of saving the U.S. steel industry. Trade attorneys talked about the impact of tariffs placed on steel imports. Among the issues they addressed were the price of steel, the state of the U.S. Steel industry, the state of competition .

US Steel Capacity Utilization . Martin’s analysis showed there is not a relationship between steel imports and U.S. steel industry capacity utilization. Capacity utilization of the U.S. steel industry actually declined during the period in which Section 201 import tariffs were in force between March 2002 and December 2003, according to the .

why are steel tariffs downstream

The answer is absolutely YES.Why don’t we buy 100% domestic?Up until about 2007 we bought 90% domestic- why did we go overseas?We buy on the following basis:Quality- We need steel that performs through our processes as well as the surface appearance.Service- We need to have delivery of ordered steel to arrive on time, as promised by our .

The Impact of Steel Tariffs on Global Trade and Industry. Steel tariffs have a long history dating back to the 19th century when governments started implementing them to protect their domestic steel industries. Since then, various governments worldwide have imposed and lifted them in response to changing economic conditions and trade relationships. The ripple effect of tariffs on agriculture extends beyond farmers, affecting global supply chains and consumer prices. Steel and aluminum: The impact of protective tariffs. The steel and aluminum industries have been at the center of US protective tariff policies, especially during the Trump administration. The intent was to boost domestic .

cnc machining in the 1950's

cnc machining in ct

cnc machining jobs seattle wa

why are steel tariffs down

For example, check that the trim control box is providing +12v on the orange wire leading to the switched power distribution block when the ignition is turned on. If not, track backwards and figure out why.

impact of steel tariffs on box springs|steel tariffs impact on manufacturing