retirement distribution box 7 If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . This product is expected to be in stock and available for purchase soon. Check back again later. Arrives approximately 1 - 2 weeks from time of order. Costco Business Delivery can only accept orders for this item from retailers holding a Costco Business membership with a valid tobacco resale license on file.

0 · irs tax distribution code 7

1 · irs 1099 r box 7

2 · form 5329 box 7

3 · form 1099 r box 7 disability

4 · box 7 r code

5 · box 7 ira contribution codes

6 · box 7 1099 r meaning

7 · 1099 r box 7 distribution

Specialised structural fabrications up to 10 tonnes unit weight. Complex platework development for process plant, storage hoppers, ducting and pipework. Water storage tanks for treatment plant.

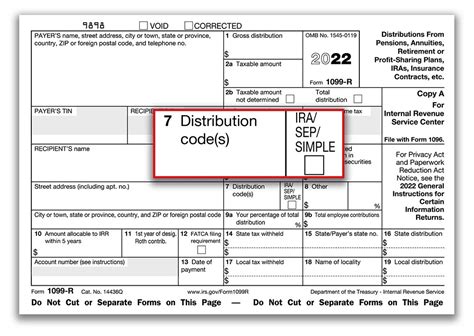

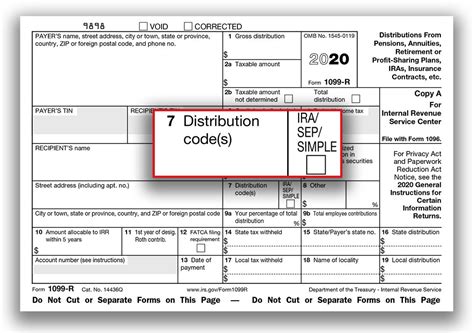

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code (s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and . Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over .

irs tax distribution code 7

L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. ** If a loan is treated as a deemed distribution, it is . Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R . It's inappropriate for the Form 1099-R to have code 3 if the distributions being reported on the form were made after you reached age 59½. Section 72(m)(7) is defined in the context of the penalty for an early distribution. Without an .

irs 1099 r box 7

Cashed out an inherited Roth IRA from parent. box 2a on 1099-R is blank and box 2b is checked. box 4 is 0.00 and box 7 is T. Is the distribution taxable? " As long as the account had been open for at least five years at the time the account holder's passing, the earnings from the inherited Roth can also be withdrawn tax-free, "

Retirement: 1099R box 7. Possible wrong code? Announcements. . Box 7 codes were P and J . . The distribution was obtained too late to be able to be done as a return of contribution to avoid the 6% excess contribution penalty on the 2020 tax return. If the 2020 tax return did not include Form 5329 reporting the excess Roth IRA contribution .Designated Roth account distribution. NOTE: If code B is in box 7 and an amount is reported in box 10, see the instructions for Form 5329. . ** If a loan is treated as a deemed distribution, it is reportable on Form 1099-R using the normal taxation rules of a retirement account. The distribution also may be subject to the 10% early .Box 7 Code. Description. Explanations . A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331. A governmental section 457(b) plan distribution that is not subject to the additional 10% tax. But see Governmental section 457(b) plan distributions, earlier, for information on distributions that may . Some reporting agencies put a qualifying explanation with a second code in box 7b when box 7(a) code is 2. This is because a box 2 code is that you don't have a penalty for the early distribution, but that box doesn't say why. Box 7b does give the explanation with a code. But it is not required for the issuing agency to put this information.

form 5329 box 7

Codes J and 8 together is correct coding to indicate a return of contribution from a Roth IRA. This is a special-case use of code J to indicate that the return of contribution was from a Roth IRA and is to be used with code 8 (or P) for any return of contribution from a Roth IRA before the due date of the tax return, even when the distribution occurred after you reached age 59½. When you receive a Form 1099-R for a retirement or pension distribution, you’ll notice that Box 7 contains a distribution code. These distribution codes are essential for understanding how your distribution will be taxed and if there are any additional penalties. Let’s break down these codes to help you understand what each one means and how it impacts .

For example, code 7 implies a distribution paid to you while code G implies a rollover paid directly from a qualified retirement plan to another retirement account, not a distribution paid to you. The IRS has no way of knowing which of these codes describes the transaction when they are incompatible with each other, and there could be a taxable . Double check Box 7 and the IRA box on your 1099-R. How will this impact my return? The distribution codes and IRA box describe the type of distribution. The program relies on these codes to make correct calculations. The distribution codes are found in box 7 of Form 1099-R. The IRA/SEP/SIMPLE box is usually located right next to box 7.

I received a 1099R with Box 7 containing codes D7. On source screen do I select "qualified IRA" or "None of the Above"? Also noted that when reviewing the screen, "None of the Above" is changed to " distribution before retirement". Is this normal? Review was made by going through update process, not.

Eligibility Criteria & Filing With Form 1099-R. Anyone who has received a distribution from a retirement plan, annuity, pension, or profit-sharing program should expect to receive Form 1099-R. Because you separated from service at 55, you are not penalized for not being 59 1/2. This meets the following 10% penalty exception: Qualified retirement plan distributions you receive after separation from service when the separation from service occurs in or after the year you reach age 55 (age 50 for qualified public safety employees). A distribution of code 3 in box 7 of your form 1099R means that you took a distribution due to a disability. If you are under full retirement age at your work then the 1099R should show up on line 7 with W2 wages and if you were over the retirement age it will be listed on line 16 (line 12 on 1040A) as pension income. For a regular retirement distribution, his 1099-R would have a number 7 in Box 7. If there is no code or number there, you should contact the Payor to get a corrected 1099-R. Here's some info about the codes in Box 7: The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received.

I received a 1099-R from my TDAmeritrade and I found out that box 7 distribution code is 2 instead of 1. I have not filed my income tax yet; so how do I correct this. I did contract TDAmeritrade two times and both times they refused to do the correction. They said that I have to contact tax advis. I left a job in 2018 with an outstanding loan from my 401k. I received a 1099R for my 2018 taxes with and M1 distribution code. I included it on my 2018 taxes, paid the income taxes, and the additional 10% early withdrawal penalty. I then received a 2019 1099R with a distribution of L1 for the same loan.Retirement distribution & E-filing . Unsolved . k box 3: You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not. US En . . Under Retirement Plans and Social Security, Start IRA, 401(k), Pension Plan Withdrawals (1099-R) 4: ,600 5: Box 7 on a 1099-R is blank. No code! Northern Trust says there should NOT be a code. . Retirement: Box 7 on a 1099-R is blank. No code! Northern Trust says there should NOT be a code. TurboTax says it needs a code. . If it was a regular distribution, go ahead and put code 7 in box 7. As dmertz points out, a 1099-R without a code in box 7 is . 6: First, how does the taxpayer want to handle the retirement distribution? 1. Report the entire distribution on their 2020 tax return. a. . Box 7, code L) • dividends paid on applicable employer securities (Form 1099-R, Box 7, code U) • the costs of current life insurance protection (Form 1099-R, Box 7, code) 7: not checked 8: Then enter the 1099-R that shows the distribution. Federal Taxes, Wages & Income I’ll choose what I work on (if that screen comes up),, Retirement Plans & Social Security, IRA, 401(k), Pension Plan Withdrawals (1099-R). Answer the follow-up questions answer the question that you moved the money to another retirement. 9: blank 10: My employer took out too much in my 401k plan. They went 5.02 over. They said I would have to submit a 1099R this year. The 1099R has arrived. I see tax was taken from this amount. In Box 7 of my 1099R I have a distribution code of 8. I am younger than 59 years old. Am I subject to a 10% penalty or a 30% penalty for early withdraw from my 401k plan even thought . 11: blank 12: not checked 13: blank 14: 1,900 15: NY # 16: blank have yet to figure out how to allow TurboTax to see how the form is being completed. Any advice is appreciated :) Codes 1 and M are separate codes in the same box 7 and each code must be selected separately in the two box-7 drop-down boxes of TurboTax's 1099-R form. The code 1 on each of the forms indicates that each of these distributions is subject to a 10% early-distribution penalty unless rolled over to another retirement account or you have a penalty .

form 1099 r box 7 disability

• If the distribution was for a 2020 excess deferral, your Form 1099-R should have code 8 in box 7. Add the excess deferral amount to your wages on your 2020 tax re-turn. • If the distribution was for a 2020 excess deferral to a designated Roth account, your Form 1099-R should have codes B and 8 in box 7. You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2016 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2018 1099-R. After the 1099-R summary screen press continue.

You are not permitted to change the code from what the payer provided on the Form 1099-R. Does the Form 1099-R provided to you by the payer have code F in box 7? I suspect not. If you had a distribution paid to charity as a QCD from an IRA, the Form 1099-R provided by the payer should have code 7 in box 7 and have the IRA/SEP/SIMPE box marked.

box 7 r code

box 7 ira contribution codes

The diagram of an electron configuration specifies the subshell (n and l value, with letter symbol) and superscript number of electrons. The Aufbau Principle. To determine the electron configuration for any particular atom, we can “build” the .

retirement distribution box 7|irs tax distribution code 7